Concerning the flat tax I think the conservatives are, in a twisted way, partially correct; a flat will work...

...if you don't want any Social Security, National Health or Universal Education. Most people however want to live in a fair society (or simply just live at all when it comes to healthcare provision) so this is not really an option. Unless, like Donald Trump, you want to be free to horde your millions; in which case a flat tax is great. That doesn't really cover many people.

Anyway here's what Mike has to say:

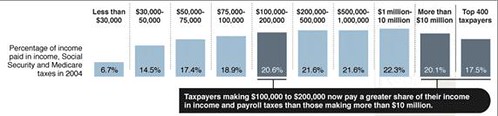

Every so often, conservatives bring up the flat tax, wherein everyone pays the same amount of income tax, regardless of how much they make. Most of these plans, unless you want to eliminate the entire Pentagon, will raise the tax burden on the lower middle and middle class, and lower them on the wealthy, further increasing income inequality. But the whole argument presumes that the wealthy actually pay considerably more of their income in tax than the non-wealthy.

By way of Kevin Drum, comes this figure indicating otherwise--in fact, the wealthiest 400 Americans pay less than middle class families ($75,000-100,000):

It goes without saying that the wealthiest Americans have far more income left over after paying taxes, which is one of the reasons why college education and housing prices have increased much faster than the median wage. You're competing with people who have far more post-tax income than you do. Good luck with that.

But what's really astonishing is that, once all taxes are factored in, we essentially have a flat tax. For $50,000 and higher, realized tax rates range between 17.4% to 22.3%. Sure, it's not identical, but I'm pretty certain that those in the top 1% can handle it.

Extra bonus observation: Most flat-tax plans don't eliminate Social Security taxes, and these taxes fall disproportionately on those who make less than $100,000 per year (there's a cap, so, for the wealthly, most income is not taxed). Middle class households would end up paying more of their income in taxes.

CONSERVATIVE WIN!!

The first commenter at Scienceblogs makes a very good point:

The biggest difference between the rich and the rest of us is that, the further you go up, the proportion of their income that derives from wages and salary (and subject to income tax) becomes much smaller. Most wealthy people get the majority of their wealth from capital gains, which is taxed at a rate about half that of wages and salary.

The whole area of economics and finance is a bit over my head, so I think we're lucky in this country to have such a fine Chancellor and before him an even better one in Gordon Brown.

A flat tax would eliminate tens of thousands of unproductive jobs both in the public and private sectors.

ReplyDeleteThe financial savings could be ploughed into education, and the tax workers could be trained for roles in education and long term care for the elderly.

I don't think you would be so blase about those "unproductive" jobs if you had one.

ReplyDeleteWho would pay for this training?

And what about the fact that a flat tax would mean that the richer you were the less of a burden your tax would be which is unfair.

I would also ask what an unproductive job is, as all jobs have a value and those that do them do as well.

ReplyDeleteSecondly if you make large swaiths of society unemployed you then go and increase the dependency on state benefits while decreasing the amount of cash coming into the exchequer through tax.

Thirdly while it is important to have new teachers and people to work in the social care field it is also important to have council officers as without them then the teachers and social workers cant do the work they need to as do you really want a socail worker tyoing up that report or a teacher spending there time ordering the books for the kids in class.

A flat tax may sound good on paper but in practice its just another way of the rich paying less and the poor suffering.